About Vista Equity Partners

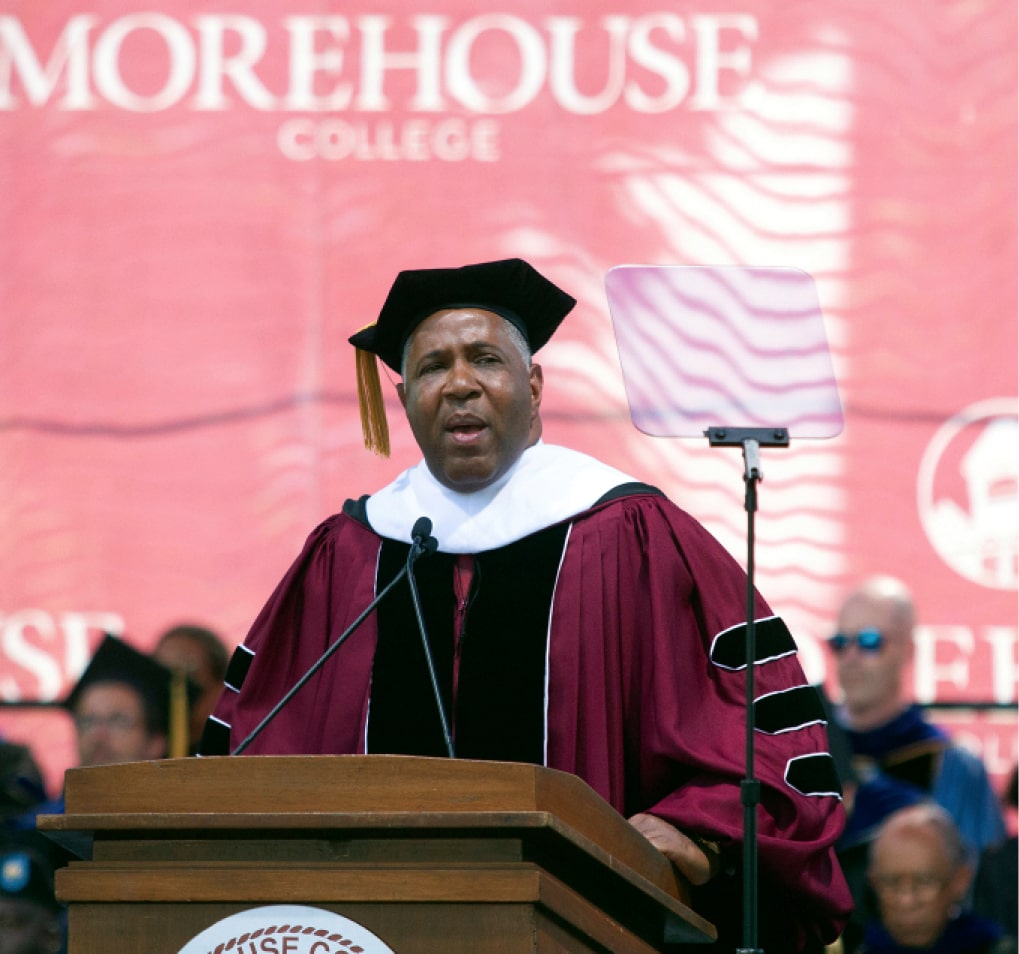

Vista Equity Partners (Vista) is a leading global investment firm founded by Robert F. Smith. The firm invests exclusively in enterprise software, data and technology-enabled businesses and leverages private equity, permanent capital, credit and public equity investment strategies. Vista manages more than $100 billion in assets on behalf of its global network of investors.

Insights and Business Philosophies

Smith founded Vista in 2000 with the belief that enterprise software would transform the global economy through advancements in connectivity and productivity. As that conviction has become reality, Vista has emerged as one of the most active investors in the enterprise software market, widely recognized for its leadership and expertise in the sector. Over time, and with each new vintage and additional strategy, the firm has adapted its ability to invest in next-generation companies while systemically expanding the Vista ecosystem.

For more than two decades, Vista has implemented a differentiated approach to enterprise software investing that prioritizes value creation through operational transformation in close partnership with founders, leaders and executive teams. This approach prioritizes the creation of enduring market value for the benefit of Vista’s global ecosystem of investors, portfolio companies, customers and employees.

The Transformative Power of Technology

Vista believes the transformative power of technology is the key to an even better future — a smarter economy, a healthier planet and greater opportunities for underserved communities. The firm continues to invest in the companies and leaders at the forefront of the digital revolution — a strategy Vista sees as the best use of capital anywhere in the financial markets.

Responsibility

Vista aims to transform the technology and asset management industries by enabling onramps to education and opportunity for traditionally underserved communities. Vista engages through a holistic approach that encompasses the firm, portfolio companies, the broader asset management and technology industries and the local communities where Vista employees live and work. By creating these onramps to opportunity and advancing diversity across its global ecosystem, Vista works to build stronger, more resilient businesses while positioning the firm for continued growth.

Building the Next Generation of Coders

Both Vista and its portfolio companies are committed to expanding educational opportunities. Vista has partnered with Code.org and their Hour of Code program to help expand student access, participation and diversity in computer science. In 2022, Smith and 27 CEOs from across Vista’s portfolio signed Code.org’s letter calling on the Board of Governors and U.S. education policymakers to update K-12 curriculum and ensure all students have the opportunity to study computer science.

Investing in Internships

Through internship programs, Vista, like Smith, is creating opportunities for individuals from backgrounds traditionally underrepresented in finance. At the same time, these internship programs help Vista build a broader pipeline of talent to power the firm’s future. Vista was a founding partner in Girls Who Invest to help increase the number of women in portfolio management and executive leadership in the asset management industry. The firm’s Frontier Fellows program focuses on recruiting rising seniors from backgrounds that have been underrepresented in the private equity industry with full-time, paid internships to prepare them for a career in finance. In 2022, Vista partnered with KIPP Public Schools and the Posse Foundation to expand their internship program to rising sophomores.

Board Diversity Stewardship

To advance diverse representation from the top down within its portfolio companies, Vista launched the External Board Program in 2017. Through the program, Vista sources qualified candidates from diverse backgrounds who bring unique insights and experiences to the board room, enhancing decision-making and accelerating value creation. To further align efforts across the industry, Vista partners with organizations such as Diligent’s Modern Leadership Initiative, The Board Diversity Action Alliance and Thirty Percent Coalition. Vista also partners with the National Association of Corporate Directors and the Society for Human Resource Management on a number of pipeline programs for Audit, Compensation, Nomination and Governance Committees of private and public company boards.