As of 2021, there are millions of retail establishments in the United States, with retail sales growing 4% annually since 2010. Despite unprecedented circumstances in 2020, the National Retail Federation forecasts that businesses and retail sales will only continue to grow. It is estimated that there will be an increase of sales between 10.5% and 13.5%, with retail sales reaching more than $4.44 trillion in 2021.

However, not all business owners are proportionally feeling the benefits of increased sales. Despite seeing an increase in business registration in some cities with above-average Black populations in 2020, Black businesses as a whole have been disproportionately impacted by the effects of 2020. In fact, according to numerous reports, Black business owners were hit the hardest.

Within the first four months of 2020, there was a 41% drop in Black business ownership, compared to the 17% drop recorded by white business owners. In a February 2021 study, it was reported that 53% of Black business owners saw their revenue drop by half, compared to 37% of white business owners. Furthermore, according to the National Bureau of Economic Research, 3.3 million businesses were forced to shut down in April 2020, shrinking the number of Black-owned businesses from 1.1 million to 640,000.

These statistics are startling, as African Americans are already underrepresented in retail. According to the U.S. Census Bureau, Black businesses only account for 6% of U.S. retail businesses, despite the fact that African Americans represent 14% of the U.S. adult population. Much of this comes down to many African American entrepreneurs having less access to capital, mentorship and growth opportunities.

Amazon’s $150 Million Commitment to Increase Black-Business Ownership

Amazon, like many other companies and individuals, has acknowledged this long-standing problem and is working to solve it. As the world’s largest online retailer, Amazon is committing $150 million over the next four years to help Black entrepreneurs become successful on their online platforms.

To reach potential new, as well as current Black business owners, Amazon has launched the Black Business Accelerator (BBA). The BBA is designed to help these current aspiring small and medium-size business owners by providing financial assistance through grants, business education, mentorship, marketing and promotion. It was created in partnership with Amazon’s Black Employee Network and a coalition of other like-minded partners.

“I’m proud to be an active member and now advisor for our Black Employee Network (BEN), which works to support Black employees, as well as embrace diversity, equity and inclusion, as valuable assets that strengthen the bonds and capabilities of Amazon,” said Lorenzo Patton, Vice President of Amazon Finance.

Currently, 60% of product sales on Amazon come from third-party sellers, which are mostly small and medium-sized businesses. In 2020, record sales growth was achieved, and Amazon would like more Black-owned businesses and business owners to be a part of the success.

Through the BBA, more current and aspiring entrepreneurs will be able to access grants to fuel their businesses and become a part of Amazon. In fact, Amazon provided their first grant opportunity, offering an initial round of $10,000 cash grants in partnership with Hello Alice. Other financial support comes in the form of Amazon credits and services valued at $3,900. Some of these services include free product imaging and advertising credits.

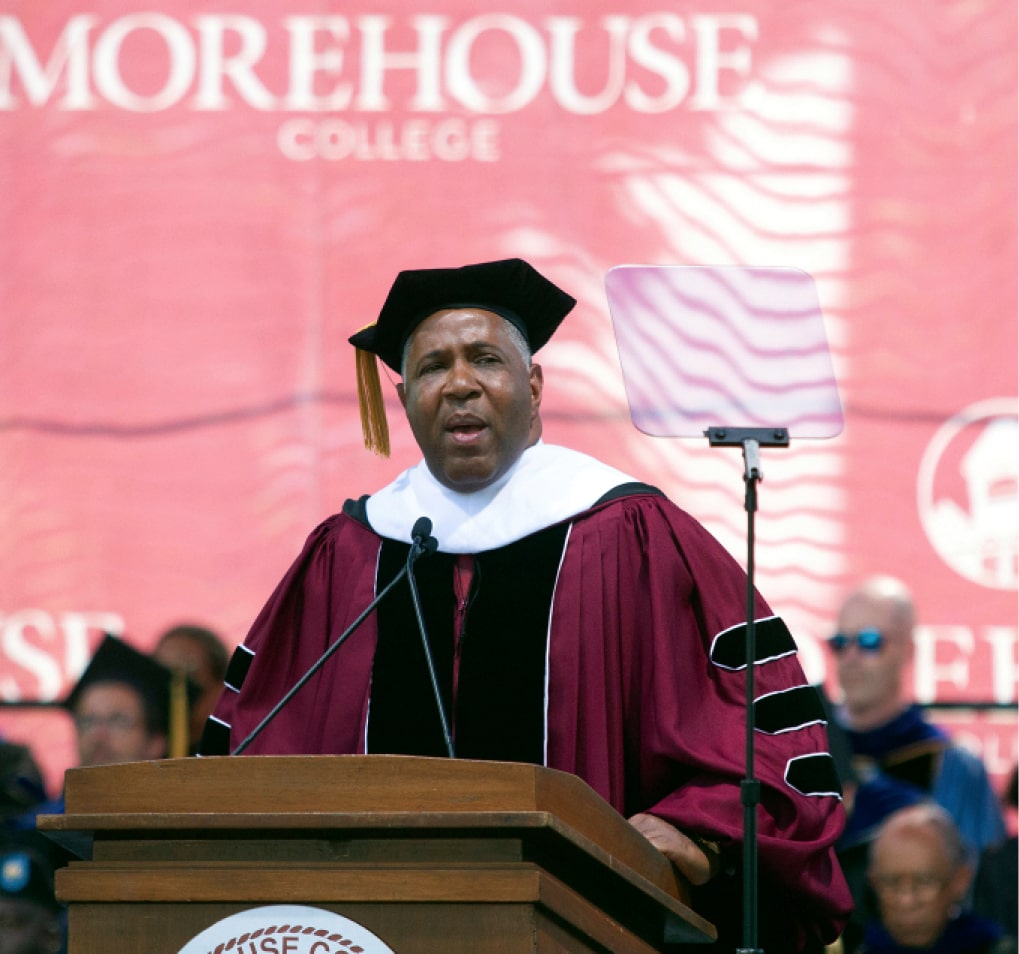

How Robert F. Smith Supports Black-Owned Businesses

Amazon is not the only one trying to help Black entrepreneurs find success. Founder, Chairman and CEO of Vista Equity Partners and well-known philanthropist, Robert F. Smith is also making his support known in many ways. In 2020, when businesses all over the country needed it most, Smith advocated for Black businesses. When the White House and Congress approved a $2 trillion emergency rescue measure called the Cares Act, which included an initiative known as the Paycheck Protection Program (PPP) that offered $349 billion in loans for small businesses, many Black businesses were locked out of receiving any of the money. Simply put, many did not have the access to the financial systems that other companies did. Smith stressed the need for the implementation of new technology in minority-owned businesses, and he called for these Black-owned businesses to establish long-standing relationships with banks. These improvements, along with loans, would provide their businesses with the greatest benefits moving forward.

When the next round of aid went out to businesses, $10 billion went to Community Development Financial Institutions, which are banks that offer loans to businesses in traditionally lower-income areas. Smith, emboldened by the government’s commitment, reached out to Black-owned businesses to reapply for the money from the PPP, seeking help from celebrities like Jamie Foxx and Magic Johnson to share his message. Through their efforts, tens of thousands of Black-owned businesses were able to benefit from the CDFIs and the PPP as a whole.

The 2% Solution: An Investment in Our Potential

Shortly after the second PPP was distributed, Smith took to advocating for another proposition that would benefit Black-business owners and the African American community as a whole. At the Forbes 400 Summit on Philanthropy, Smith called for The 2% Solution, advocating that businesses within the United States invest 2% of their profits for 10 years into communities that have been most affected by systematic racism. One option would be investing in community development financial institutions and minority depository institutions that primarily service Black communities, especially Black businesses.

“The first thing to do is put capital into those branch banks to lend to these small businesses to actually create an opportunity set . . . drive it into these small businesses, which employs 60%-plus of African Americans,” said Smith at the Summit.

If the biggest U.S. companies invested just 2% of their net incomes, some $25 billion could be used, not only to strengthen and digitize small Black businesses, but also improve healthcare infrastructure in minority communities, equalize broadband access and fund STEM education at historically Black colleges.Learn more about how the Black Business Accelerator and the Robert F. Smith-supported 2% Solution can help Black entrepreneurs.