Whether a company is in its startup phase, launching a new product, or organizing recruitment and retention programs, diversity and inclusion in the workplace are absolutely critical for success. Studies have shown the value of diversity in organizational structures and noted that diversity promotes a wide range of ideas, perspectives and experiences. It also helps to improve decision-making to better serve and understand a broad consumer base. Learn more about the importance of diversity in the workplace and ways to improve it.

What Does Diversity in the Workplace Mean?

5 Benefits of Diversity in the Workplace

1. Increasing creativity and innovation

Diverse workplaces produce environments where employees bring their unique perspectives to their jobs. These experiences can lead to out-of-the-box thinking that can improve strategic initiatives. Moreover, a diverse workplace that brings together employees of varying backgrounds allows for companies to deploy more holistic strategies, able to connect to a wider range of audiences.

2. Improving performance and increasing market share and profits

3. Bolstering brand identity and reputation

4. Recruiting and retaining high-quality talent

5. Complying with the law

Get Industry leading insights from Robert F. Smith directly in your LinkedIn feed.

Get Industry leading insights from Robert F. Smith directly in your LinkedIn feed.

What Are Some Challenges of Diversity in the Workplace?

- Biases in workforces: Even hiring managers with the best intentions may encounter unconscious biases that exist within their workforces as they seek to diversify. For example, many company leaders are hesitant or unwilling to agree to diversity targets because of their own biases.

- Lack of support for underrepresented employees: Companies may experience growing pains when diversifying their workforce, specifically as it relates to ensuring support for new employees. Companies should understand this and implement strategies to listen to all employees’ perspectives.

Why Is Diversity Important in the Workplace?

- Reducing discrimination and unconscious bias: A more diverse workforce can expose outdated practices and belief systems that may be present in a company. The introduction of a variety of backgrounds and perspectives can allow groups the opportunity to challenge the status quo in the hopes of improving work products. This could lead to implementing more equitable policies and expanding company programming that addresses equity and inclusion.

- Fostering a more inclusive work environment: More representation in the workplace can allow for all voices to feel comfortable sharing their perspectives and ideas. Moreover, the visibility of underrepresented employees in companies can have a downstream effect that could encourage more prospective employees to apply as well as for all current employees to pursue leadership positions.

- Improving decision making and problem solving: Expanding the variety of voices in deliberations provides companies and organizations the opportunity to deploy creative and unique strategies. This, in turn, can make businesses more competitive.

How To Improve Diversity, Equity and Inclusion in the Workplace

- Recruitment: Companies can dedicate resources to recruiting underrepresented candidates to their organizations through outreach and advertising.

- Training: Implementing equity and inclusion trainings can help foster a more inclusive workplace that can help companies retain a diverse workforce.

- Reviewing company policies and practices: Doing regular reviews of company policies can allow for refreshing outdated practices, which could help recruit and retain more underrepresented employees.

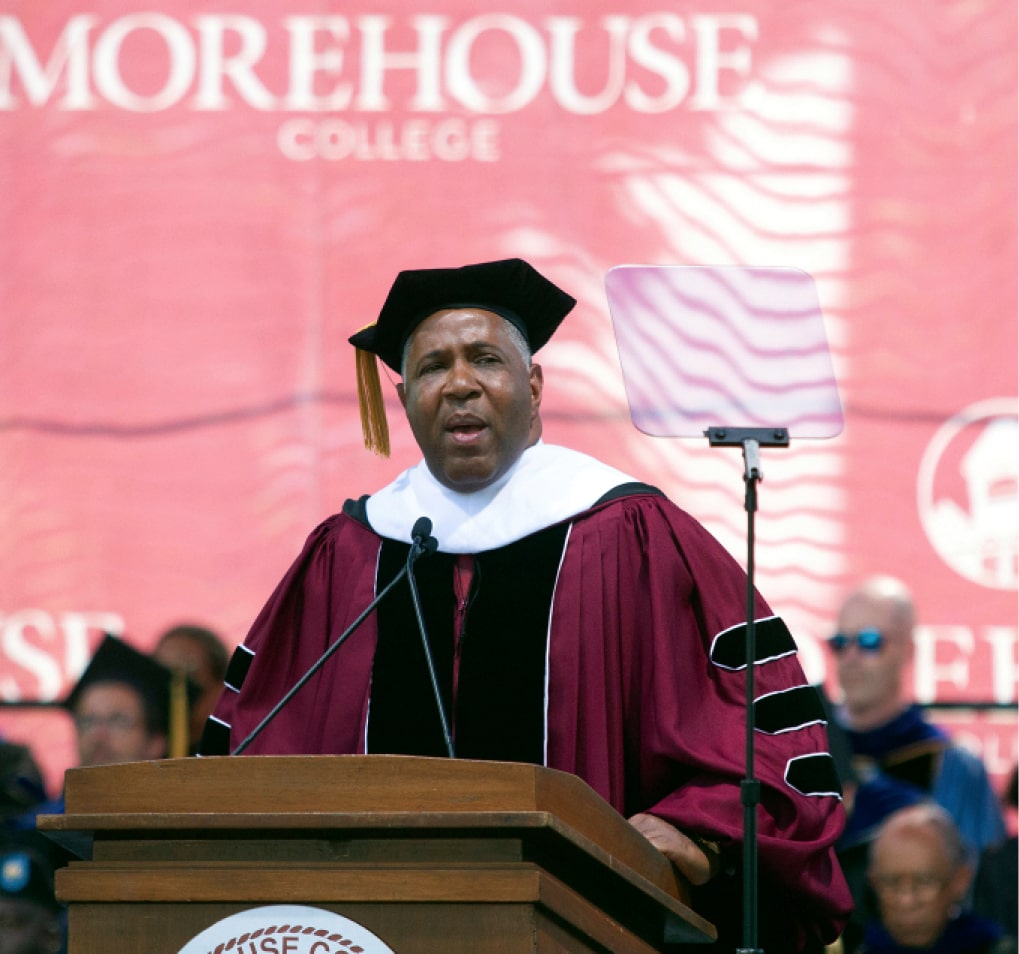

How Robert F. Smith Promotes Workplace Diversity

Robert F. Smith, Founder, Chairman and CEO of Vista Equity Partners (Vista), is a leader in promoting the importance of workforce diversity. Smith credits his internship experience at Bell Labs as a student at Cornell University for introducing him to new, valuable concepts that expanded what he learned in the classroom and encouraged him to pursue a career in STEM. After he earned his bachelor’s of science in chemical engineering, Smith pursued a career in chemical engineering at leading corporations like Kraft and developed his own patents, one example of the power of providing internship opportunities to underrepresented candidates.

Smith has prioritized workforce development throughout his career, both through business and in his philanthropic endeavors. Vista is also a member of the Thirty Percent Coalition, which advocates for diversity in the corporate boardroom. Smith is also a member of the Business Roundtable’s Racial Equity and Justice Task Force, which identifies ways to address systemic inequity, including in workforce development.

Smith supports increasing internship opportunities through internXL, which connects underrepresented college students to internships across industries. internXL also provides college students with mentorship and networking opportunities, as well as assistance with student loan repayment.

Follow Robert F. Smith on LinkedIn to learn more about him and other interesting topics.