For years, Black-owned banks have successfully made capital available to a greater percentage of Black applicants than loans from other banks. They’ve also been a huge benefit to the communities they serve — especially as nearly 70% of Black communities lack a single traditional bank branch, according to Robert F. Smith.

However, the number of Black-owned Banks are dwindling. America boasted 36 Black-owned banks 15 years ago — now there are just 18, according to new government data.

The lack of Black-owned banks has major ripple effects for communities of color. For example, a Wall Street Journal analysis of federal data showed that would-be borrowers in Black neighborhoods would be less likely to have their home loans approved than borrowers in other neighborhoods over the past decade. This impact was acutely felt this spring when Congress passed the Paycheck Protection Program (PPP) that largely shut out Black business owners because the program prioritized traditional lenders and banks where people of color are less likely to have relationships with.

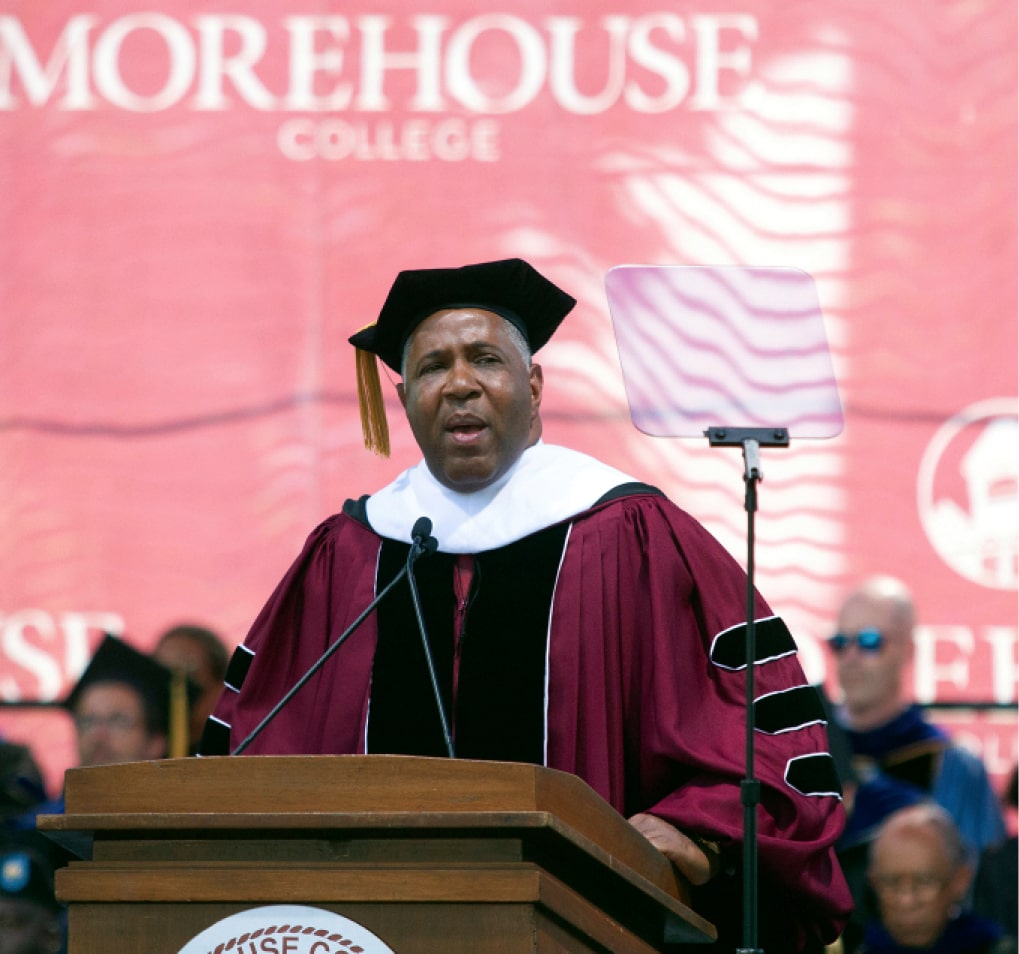

“The deprivation of capital is one of the areas that creates a major problem to the enablement of the African American community,” Robert F. Smith said during Forbes Philanthropy Summit. “The first thing to do is put capital into those branch banks to lend to these small businesses to actually create an opportunity set…drive it into these small businesses, which employs 60 percent-plus of African Americans.”

Smith has also been vocal about the need for the private sector to play a role in addressing the racial wealth gap by giving at least 2% of its profits to empower Black communities, which could provide billions of dollars to Black-owned businesses, banks and community development efforts.

Learn more about Robert F. Smith’s 2% Solution and the fight for equitable investments in the Black community.