The following is a transcript of the video of Smith and Andrew Ross Sorkin of CNBC at the WEF Davos. In the interview Smith talks about the future of capitalism, the digital divide and onramps to prosperity:

Andrew Ross Sorkin: So the big theme here as we all know is this idea of the future of capitalism where it said in this idea of multi-stakeholder capitalism and you’ve had lots of success but you’ve also had a lot of just thinking about these different stakeholders.

So how do you see it?

[0:15]

Robert F. Smith: So, the dynamic for us is one of necessity and always has been since really the founding of Vista…and I’ll unpack that a little bit. When I think about the world I live in, enterprise software, one of the dynamics enterprise software has done is create massive productivity in companies and existing businesses because it’s business-to-business software, you know?

That’s a dynamic that created huge wealth. And you know, for capitalists, those who held capital in those companies, in the course and after you actually create income opportunities for people who work in those businesses.

[0:47]

So that’s what you’re seeing, you know, you’re seeing that disparity of income and wealth driven by the fact that technology has this massive protocol impact on these businesses. And now it’s being recognized and the recognition of it is something people say, oh my goodness we’re seeing, you know, for the first since 1930 the biggest disparity in both wealth and income and we have to do something about that, you know? In the ESG initiative concept of it, the world of enterprise software, we’re actually pretty good on the E side, for the most part, we generate, use a lot of power, and we also have good footprints associated with travel. But, for the most part

we’re pretty clean, but it’s the ESPer, okay? The impact that followed, you know, Social. How do we make a more inclusive environment? We have had to do it by necessity, because we need talented people. And, if you stuck to the traditional pools of people, you couldn’t actually fill the roles and the jobs.

I’ve got seventy five thousand plus employees. I have five thousand open recs. I just go to the same places everyone else has gone, I can’t fill those recs.

So we have had to always open up our aperture for people and so in doing so we have the most diverse workforce and private equity; the most diverse workforce in technology, by any measure any standard objective measure really across the planet.

Sorkin: But when you started doing it.. But when you say necessity though? Was it a necessity or did you say to yourself, “You know what, I want to do it differently.”

[2:03]

Smith: It’s… it’s a bit of both, right?

You know, the necessity was we needed the people and if you go to the same place, you can’t find them. So, where do you wanna go? You go to places where you have very smart and talented people who need on-ramps into this economy.

And when you look at the world of private equity in software and our companies and business in particular, the business and applications we have. We paid two times the average private wage. So it actually transforms an opportunity for an individual worker in our business.

And of course if they are a stakeholder in the business, a stockholder, etc., it transforms the wealth dynamic for them.

[2:32]

So we always talk about, you know, the Trojan horse of our business, you know? Being African American, I have the opportunity to actually think about; how do I transform a community of Americans, African Americans, into this fourth Industrial Revolution which you and I have been talking about for four or five years here.

So, you know part of it is by design, and a part of it is, you know, an obligation to a great extent, to actually make the changes that I know are right.

Sorkin: Do you think these changes are happening outside of your firm? I mean, there’s a lot of talk here about these things, but is there a lot of action?

Smith: You know, the good news about Davos and all its criticisms: it gives people like me, and not me, can actually connect with senior executives to affect a change. So, we developed a program through the Fund II Foundation called internXL. And the whole point: my career started at Bell Labs, 17-years old as an intern. Well, how do we get more African Americans and women into internships? So we created a platform in essence, a matching platform, but now I come here and get real commitments from Chuck Robbins at Cisco, okay? Backed in, John Donham from AT&T, and you know, Dan Schulman at PayPal and just got one big commitment. And got the number, yes, from AIG.

So, the whole point is not just an on-ramp. By having these CEOs commit to — you know what this would make sense Robert — we want to do it; how many; if they… John will say, “Oh Robert I’ll give you 500 internships.” Great, and now we’re able to fill those. Now 500 African Americans or women now have a chance to participate in the Fourth Industrial Revolution as interns and then ultimately become full-time employees. So, it works. It matters. But here’s a place for you to actually connect.

Sorkin: And it’s not just hype.

Smith: No. For us it isn’t.

Sorkin: Because that, but, but that is the, the critique here in Davos, right? Is that a lot of people?

[4:04]

Smith: Yeah, but I’ll tell you, you know, my experience, but I came here on a mission. Right?

Sorkin: Right.

Smith: So, my experience actually leads to real outcomes and otherwise I wouldn’t bother.

Sorkin: When you think about the idea of capitalism though — just even the concept in the United States right now. There’s a debate about whether it even works. And I’m especially curious about how you think the African American community thinks about the idea of capital reserve.

Smith: Sure. That’s a long conversation. If you think about it, capital, this whole idea of capital versus… like capitalism still is the most efficient system on the planet for uplifting humanity generally. But of course, you know, in general we go up, but we have individual pockets who don’t necessarily participate. African Americans have traditionally not participated. In fact, you know, you go look at the, you know, the Homestead Act, the southern Homestead Act, you know? Redlining around their communities; inability to actually gain a foothold in the capital part of capitalism. And so, they’ve always been part of the labor part. Right?

Sorkin: Right.

[5:02]

Smith: Right and that’s the dynamic. So part of what we have to do and what we do do is how do you move them into capital. There’s been [announced] about how do you drive capital into these communities, some of which are policy driven, okay? Some of which are actually individual and some are philanthropic.

So I think we now have, in the first time in the history of this planet, where you can actually generate capital — not owning capital, i.e. intellectual property, using technology, okay? In one generation. But you have to get on-ramped onto this technology revolution.

You got to get on the internships, experiences, that actually get you into these software companies, technology companies. That’s what I’m working on.

Sorkin: Do you think young people today in America appreciate that? Especially given the political climate we’re in in which there really is a stark contrast between the two parties and even within the Democratic Party around this idea of capitalism and socialism.

[5:52]

Smith: I don’t think we’ve done an adequate job explaining to young people what are the benefits or profits in a corporation. And the corporation’s haven’t done an adequate job of taking and showing how those profits improve the community in the station.

The good news, you know as with Chuck yesterday at Cisco we’re talking about — listen, here’s how we’re educating and training and dealing with homeless problems in Santa Clara, California. One of the wealthiest counties on the planet. But of course as as people got, you know, wealthier …and that it displaced people. And but how do you now take care of that?

The government doesn’t necessarily handle some of those issues but folks who are running businesses can because they realized if we don’t make our communities sustainable, we will not have sustainable businesses.

All right? But we haven’t done, I think, a great job as companies explaining the virtues of capital, the virtues of profit. And I, you know, as you know, Andrew Carnegie has been a big hero of mine.

[6:39]

We don’t go through the gospel of wealth with people who help them understand the role of folks like me is to actually drive and manage the disparities, using philanthropy as a tool and as an instrument to actually manage some of the some of the issues that come from, you know, capitalism and profit has been my primary motivators.

Sorkin: President Trump’s often talked about what he says is his record for employment for African Americans in the United States under his administration. Do you think the African American community appreciates that point?

Smith: I think, you know, if you didn’t have a job and you have one now you do appreciate it, you know? When did it start? Is it now a gesture? But now we’ve got record employment that, from what I can tell, that is true.

Now the real question is: is it just leading to income or is it actually leading to wealth? You know, part of what I think about it is how do you convert that income to wealth? Well typically in America, it’s been through land ownership.

[7:29]

What does that mean? Buying a house. Having to afford that house to actually appreciate the neighborhood: to borrow, and use the capital to send your kids to school. So they have the next opportunity to improvements of capital for your family.

So, like all things. It’s a great start to get income, but we now have to convert that income to capital into these communities. That’s what African Americans are looking for — is we didn’t participate in, like I said, that you know, some of the the land grants and the Homestead Act and some of the southern Homestead Act.

That led to a basis of capital for a lot of non-Black Americans that their families have been for generations, you know, taking advantage of. Well, the whole point is now how do we ensure that this this group of folks, African Americans, have a chance now to participate in it, in that economy. But they’ve been excluded for you know, eight, nine generations.

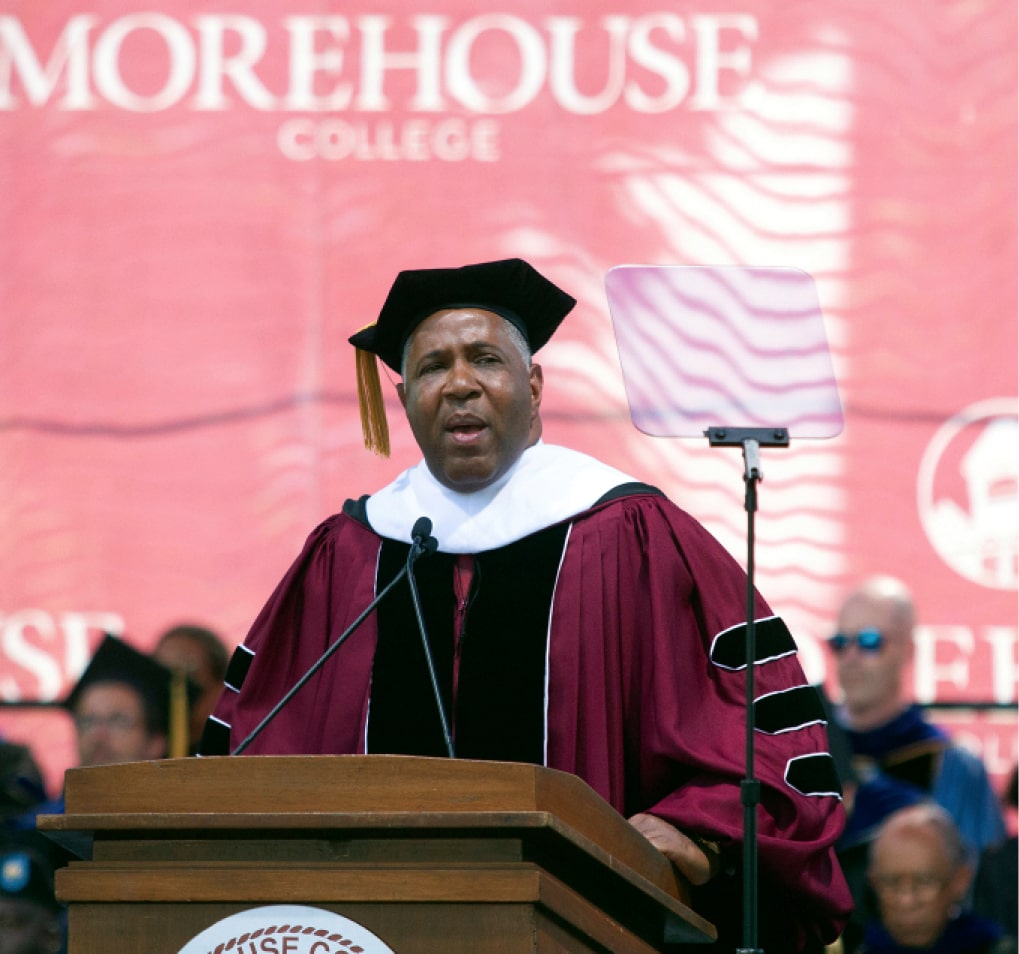

Sorkin: Tell me about the Morehouse donation. Tell me how you thought to do that. How did it come about?

Smith: The whole inspiration really comes from, you know, I call it an ideological position around how do you liberate the human spirit?

[8:28]

I don’t think there’s anything more beautiful than the liberated human spirit. And, you know, the work that I do at Carnegie Hall for instance. We get to about 600,000 kids a year bringing a music education where it was taken out of the public school systems.

And when you see a child liberated; and music can liberate you; education can liberate you; in some cases the liberation of a burden of debt. Because you took the initiative to go to a college to get educated, take on debt. And in your family, your mother, your grandparents took on debt so that you could be the first one in your in your family to graduate from college, to go get a job. And now you have a burden of debt that may prevent you from actually buying a house for another 20, 25 years.

So when I thought about my capacity: as human being; as an African American; as an African American male businessperson. What’s a good way to liberate a spirit? What’s the way to liberate 400 spirits, 400 years after 1619.

And so when I thought about it I said, “this is a good way to do it.” There’s multiple ways that I thought this was a good way to liberate 400 people and say the only thing I want you to do is go give back to your community in ways that you think are important. That’s why I did it.

Sorkin: And how did you decide to do it the way you did us a surprise?

[9:40]

Smith: Because if you know how it is. You know how you journalists are. If you tell anybody in advance it leaks and it loses the impact. I wanted these young men to really think about graduating what it meant to their parents, their grandparents, in the audience. When you meet some of the parents and grandparents who’ve come from all sorts of places; who saved money; borrowed money. You know? You want them thinking about just the joy of them graduating and then at the end saying here’s something else. When someone from our community, our community, is gonna help you.

Sorkin: When you saw that joy, what did you think? It was something just to go… I saw it on video. I know you were there in person you saw right there.

Smith: It was one of the most beautiful expressions I’ve ever seen: a human spirit liberated en mass. It was wonderful.

Sorkin: A related political question. There have been some presidential candidates and other politicians who suggested that one of the things the U.S. government should do is forgive college debt across the board. Do you believe in that?

Smith: It’s complicated, you know, there are some folks who have college debt for 20 years. And if you forgive it, the past, what about the future? One of the things I’m working on now, which we hope to announce, I’ll call it, “in the coming months.” I have actually a very brilliant friend — he used to be a former commissioner for the IRS — Fred Goldberg, working on a program, where if we do it the right way, we will be able to eliminate the student loan burden for all African Americans who study STEM going to HBCUs. And that’s kind of forever going forward but not how do you do it with the pieces with people who have that debt today? Is it fair to them don’t know. So government can do some things with past. Question is what we do for the future? Or you can do things to the future — what do you for — focus on the past burden. The short answer is we have a problem: that student debt burden is bigger then I think the consumer debt at this point. We don’t have a mechanism, so it’s sustainable, yet.

And the most important thing that lifts people in their station life is education and we have to make it in a way that’s affordable and effective, not just affordable but effective. And they actually have something to do afterwards that can contribute to the you know, that contributes to society.

[11:50]

Sorkin: Technology question that relates to Vista.

There’s a huge debate in Washington and elsewhere about big tech and the role of big technology companies in terms of stifling innovation. Not just in terms of competition, but in terms of actually the ability for example for companies where who you’re gonna sell to eventually if you buy a company, create a company, who you’re gonna sell to. Do you think there’s a problem?

Smith: I don’t. Let me tell you. You know, what we, you know, as big as we are really the fourth largest enterprise software company in the world if you aggregate all of our holdings. The key is aggregating all the holdings. You have sixty five. We just sold a software company, so sixty four software companies. And each of them sell to specific verticals or horizontal and provide specific services to that event or instance. The key in my mind as an investor is, think about: do we actually have the ability to create value for our customers? And that’s the most important thing. On average our companies have a 650 percent ROI for the products we sell to our customers. So there’s massive demand for it because it creates massive productivity into their, into what they do.

[12:56]

So that’s kind of point number one. Point number two, enterprise software at least, has a high free cash flow component to it. So, while you may not be able to quote unquote, sell one of our businesses. They deliver a fair amount of cash. So you can always return capital to your shareholders at a fair rate.

Sorkin: How much you worry though that the AWS is the world the Google clouds the Microsoft Azures are gonna start building in some of this type of functionality, though, into their quote unquote stack.

Smith: Yeah. Yeah, there is there is always that that’s the nature of competition. That’s the nature of capitalism. Right? And so part of what we have to do is be thoughtful and anticipate and still be the best debrief. You know, enterprise software and software companies still are, you know, winner-take-most type of businesses. Those who have a superior product will often dominate that market for periods of time, you know. We have seen this many times in history.

[13:40]

The last time we saw the wide disparity in wealth and income, what happened? You had a concentration of wealth in businesses that actually dominate certain segments. The government stepped in at that point in time. You tell me was the aftermath worth it or not? Who knows? Right? But there’s a dynamic here where you’re actually seeing that. Because, if you are a first mover and you’ve built walls around those organizations technically or through, you know product superiority or some execution excellence dynamic, you might be in an on that market for four decades.

And the question is, does it make it anti-competitive or does it make it just more efficient for everyone that you serve and create a lift in the rest of the industry. I would argue today, because of this massive distribution of technology and computing power and connectivity. And now the applications that are part of it. We have as society, on whole, benefited greatly, lifting people out of poverty, education, you know health care. All those sorts of things are because we’re utilizing this technology well. But not everyone has the same sort of opportunity.

[14:36]

We did great on the whole and not in all of the parts. And so that’s where government steps in and tries to figure out what it is, is the right answer or as we as business people thinking about, here’s the place I can make things more efficient through investing in technology and R&D.

That’s a complicated question. But I think, you know, I like the free markets as the best way of the answer, as opposed to regulated markets in that context.

Sorkin: Robert Smith. You’re an inspiration.

Smith: Thank you.