Key Takeaways:

- Between 2017 and 2020, the number of Black-owned businesses increased by 14%, but they still represent just 3% of all firms.

- Despite the inequitable barriers that Black entrepreneurs face, many have become famous, including Founder and Chairperson of Urban One, Inc., Cathy Hughes, and Founder of FUBU, Daymond John.

- Entrepreneurs from underrepresented communities can apply for and utilize several grants, such as the Rebuildtheblock’s Bridge the Gap Fund.

For centuries, Black Americans have experienced many barriers to success, especially in business. And while our history is full of many famous entrepreneurs, very few famous Black entrepreneurs are regularly recognized. However, despite inequitable access to entrepreneurial opportunities, many Black Americans have, and continue to, thrive against all odds.

Below, we explore the current state of Black entrepreneurship in the U.S. and list the stories of 12 famous Black entrepreneurs. In addition, we explore several key grants available to Black entrepreneurs.

The State of Black Entrepreneurship in the U.S.

The number of Black-owned businesses and entrepreneurs in the U.S. has steadily increased in the last few decades, but they still account for a tiny percentage of businesses. According to the U.S. Census Bureau Annual Business Survey (ABS) provided by the Pew Research Center, more than 140,900 Black-owned businesses exist. This number is a 14% increase from the total number of Black-owned businesses in 2017.

While this growth seems significant, it loses its luster when you consider the statistical facts. To put it into perspective, data from the U.S. Census Bureau shows that Black Americans accounted for more than 12% of the U.S. population in 2020, but Black-owned businesses accounted for just 3% of all U.S. firms.

A List of Famous Black Entrepreneurs

Black entrepreneurs excel across a wide range of industries, from entertainment and sports to the food industry. Below, we highlight entrepreneurship by exploring 12 of the most well-known Black entrepreneurs in history.

1. Robert L. Johnson and Sheila Johnson, the Founders of BET

Robert L. Johnson and Sheila Johnson changed the world of media forever when they founded the Black Entertainment Television (BET) network. The formerly married couple developed the network in 1980 to create a dedicated cable TV channel for Black Americans. After working tirelessly to expand the network from two hours of programming to an international offering, they sold BET to Viacom for $2.9 billion.

The 2001 sale made the couple the first Black billionaires in the U.S. Later, BET became the first Black-owned company traded on the New York Stock Exchange. Robert L. Johnson went on to become the first Black American majority owner of a professional sports team, the Charlotte Bobcats NBA team. Sheila Johnson became an investor and the first Black female entrepreneur to be a part owner of three professional sports teams: the WNBC Mystics, the NBA Wizards and the NHL Capitals.

2. Jay-Z (Shawn Carter), Founder of Roc Nation

Shawn Carter, known as Jay-Z, is well known for his musical career as a rapper, but he is also a business mogul. His determination to make it out of his often dangerous childhood neighborhood in Brooklyn, NY, fueled his entrepreneurial spirit. Jay-Z’s first notable business endeavor was Roc-A-Fella Records, which he founded in 1995. Although the label developed some of the best rap music of the 1990s and 2000s, it was shut down in 2013. In 2018, he started another label known as Roc Nation.

Jay-Z has also explored a number of other successful business ventures, including the clothing line Rocawear, the 40/40 Club and the sports management group Roc Nation Sports. Additionally, he pioneered the development of the first artist-owned music streaming service, Tidal.

While it may be hard to believe, the aforementioned projects are just a portion of his ventures. His business prowess and passion have catapulted him to become a leading source of inspiration for aspiring entrepreneurs and one of the most famous Black entrepreneurs.

3. Cathy Hughes, Founder and Chairperson of Urban One, Inc.

Urban One, Inc., previously known as Radio One, was developed by entrepreneur Cathy Hughes. Hughes started the company to share Black American stories across TV, radio and digital media. Her humble upbringing in Omaha, NE, inspired her determination to succeed.

Hughes started her career at her local radio station in her hometown, but moved on in 1971 to become a lecturer at Howard University. She later became the sales manager of the school’s radio station. Hughes was the first female vice president and general manager of a station in Washington, D.C. and pioneered a revolutionary new radio format called “Quiet Storm.” The format transformed urban radio and was used at hundreds of stations across the U.S.

In 1980, Hughes purchased her first radio station in Washington, D.C., which she grew into Urban One. Today, Urban One is the biggest Black-owned and operated broadcast organization in the U.S. with 56 stations.

4. Daymond John, Founder of FUBU

As one of the most well-known Black entrepreneurs, Daymond John is commonly referred to as a millionaire business mogul and an investor on ABC’s Shark Tank. However, John was not simply cast in the spot; he had earned it with his impressive entrepreneurial journey.

In 1989, he started his clothing line, FUBU, with a $40 budget to pursue his teenage dreams. FUBU was not an overnight success. During the first few years after he started his line, he also worked at Red Lobster restaurant. John’s grit and hard work turned FUBU into a $6 billion fashion industry powerhouse.

Today, John is also the Founder and CEO of Blueprint + Co., a coworking space in New York City, and The Shark Group, a brand management consulting agency. John is estimated to have a net worth of more than $250 million.

5. Richelieu Dennis, Founder of Sundial Brands

Richelieu Dennis is the creator of one of the largest natural beauty companies in the U.S., Sundial Brands. Dennis’s journey began in Liberia, where he grew up during a violent civil war. After years of working to get out of the country, his opportunity came when he received a scholarship to Babson College. Several hours after his mother flew out to see his graduation, their Liberian home was destroyed. Post-graduation, Dennis and his mother had no jobs or a home to go to.

To develop a source of income, Dennis started developing bath and body products using his grandmother’s recipes. He and his mother sold the products on the side of streets throughout New York City. Within weeks, they expanded to selling to vendors, local markets and small shops. Together with his mom and classmate, Dennis created Sundial Brands.

When Unilever took over Sundial in 2017, the deal also established a $100 million New Voices Fund dedicated to uplifting female entrepreneurs from underrepresented communities. The year after, Dennis acquired the lifestyle magazine Essence and restored it as a Black-owned publication.

6. Ursula Burns, the former CEO of Xerox

Ursula Burns is the former CEO of Xerox and the first Black woman to head a Fortune 500 company, making her one of the most notable Black female entrepreneurs. While Burns grew up in a low-income housing project in Manhattan, her mom worked several jobs to afford to send her daughter to private school. Her mom’s hard work inspired her to work hard in school. Burns pursued her gift of math by earning a bachelor’s degree in mechanical engineering at the Polytechnic Institute of New York University. In 1980, she started her master’s degree in mechanical engineering at Columbia University and became an intern at Xerox.

After she completed her master’s, she accepted a full-time position at Xerox in product development. From then on, Burns blazed a path for herself at the company by taking on new roles in management and engineering. In 2000, Burns was made the senior vice president of corporate strategic services, which provided her with insight into different areas of the business. Seven years later, she became the president of Xerox and was officially named CEO two years later.

After stepping down from her position as CEO, Burns served as the CEO of Veon, a telecommunications firm. Burns currently works with several large corporate boards and advocates for inclusive capitalism and racial equity.

7. Tyler Perry, Founder of Tyler Perry Studios

Tyler Perry is a playwright, actor, screenwriter, director and founder of Tyler Perry Studios. Perry was raised in a poverty-stricken and abusive home in New Orleans, LA. To cope, Perry would record his thoughts and experiences in a series of letters to himself. These letters later motivated Perry to write his first play in 1992.

The first showing of his play did not sell out as he had imagined. However, several years later, Perry put on the play again and sold out the theater. Hungry for more success, he pushed himself to write thirteen plays over thirteen years. In 2005, Perry broke into film with the movie “Diary of a Mad Black Woman,” which skyrocketed to the number one spot at box offices across the U.S. The next year, he started Tyler Perry Studios.

In 2007, Perry broadened his media presence with “House of Payne,” his first TV series. This series became the most popular first-run syndicated cable show in TV history. In 2012, Perry partnered with Oprah Winfrey to develop programming for the cable network OWN. Three years later, he relocated Tyler Perry Studios to Fort McPherson Army base in Atlanta, GA. Today, Tyler Perry Studios is one of the largest major motion picture studios in the U.S., and Perry is one of the world’s most successful black entrepreneurs.

8. Micheal Jordan, Partner of Nike’s Jordan Brand and Investor in DraftKings

Michael Jordan is known as one of the greatest basketball players of all time, but he is also an investor and entrepreneur. Jordan started his career by playing collegiate basketball at the University of North Carolina at Chapel Hill. After leading the school to several victories, he left his junior year to join the U.S. basketball team, which he led to two Olympic gold medals. Jordan’s basketball career hit new heights when he was drafted by the Chicago Bulls in 1984. Jordan helped the Bulls achieve six National Basketball Association (NBA) championships and played with the NBA for 15 seasons.

During his first year with the Bulls, Jordan signed a deal with the shoe brand Nike under his mom’s guidance. Not only did she help him acquire a deal with his own shoe line, she negotiated that her son should earn a percentage of every pair of shoes sold, which was unheard of at the time. His shoe, Air Jordan, made $126 million within three years, which exceeded the company’s initial expectations by $123 million.

This partnership with his mother ignited Jordan’s entrepreneurial spirit and inspired him to do brand partnerships with notable companies, such as Coca-Cola, Chevrolet and Gatorade. Jordan is also a part owner of the Charlotte Hornets basketball team and the Miami Marlins baseball team. In addition, he has several other business endeavors. He is a co-owner of a NASCAR team, is an investor in the sports betting app DraftKings and owns a tequila brand and a few restaurants.

9. Janice Bryant Howroyd, Founder and CEO of ActOne Group

Janice Bryant Howroyd is a Founder and CEO of ActOne Group, an employment and consulting agency. Howroyd credits her basic entrepreneurial skills to her childhood experience in Tarboro, NC, where she grew up with 10 brothers and sisters. After moving to Los Angeles, CA, in 1976, Howroyd briefly worked at Billboard. Two years later, she set off on her own and opened ActOne Group with just $1,500. With a lot of hard work and grit, she expanded the company into a multi-billion dollar organization that operates in 32 countries.

Howroyd is the first Black woman to achieve this type of success, making her also one of the most successful Black female entrepreneurs. In 2023, Forbes recognized her as one of America’s Richest Self-Made Women. In addition to ActOne Group, Howroyd uses her business prowess and experience to uplift underrepresented communities. Specifically, she works to provide people from these communities with opportunities in business and education.

10. Serena Williams, Founder of Serena Ventures

Serena Williams is known as one of the greatest tennis players of all time. She developed the core values that served her throughout her athletic and entrepreneurial journey when she started learning to play tennis at an early age. Instead of signing his daughters up for classes, Williams’s father started training them himself starting at age three. Williams’ roster of wins includes 23 Grand Slam singles titles and four Olympic gold medals. Off the court, she also makes an impact.

In 2009, Williams and her sister, Venus Williams, became the first Black women to be part owners of a National Football League (NFL) team when they purchased shares of the Miami Dolphins. In addition, Williams ventured into other business endeavors, including clothing, film and TV. In 2011, Williams became a UNICEF International Goodwill Ambassador. Recently, Williams partnered with UNICEF on its #EveryChildAlive campaign. Together, they promoted the importance of providing affordable, equitable health care for every mother and baby.

In 2019, Williams founded her own venture capital firm, Serena Ventures, which invests in tech companies owned or run by people from underrepresented communities.

11. George Foreman, Co-Founder of Foreman Boys and Founder of George Foreman's Butcher Shop

George Foreman is known for his boxing career. Foreman grew up in an impoverished household in Houston, TX. Because he was getting into trouble, he was sent to attend a camp in Oregon dedicated to helping disadvantaged kids learn vocational job skills. It was there that Foreman first learned to box. Shortly after, he started to train as a boxer, which landed him a spot at the 1968 Olympics in Mexico City. There, Foreman won his first and only gold medal. A year later, Foreman emerged as a professional boxer and quickly gained success. After nine years in the ring, he retired to focus on becoming an evangelist.

However, Foreman returned to the ring in 1987 and quickly made a name for himself again. When he was 45 years old, he regained the heavyweight title and became the oldest world heavyweight champion. In 1997, he officially retired from boxing with 76 wins.

Retirement did not slow Foreman down. He continued doing infomercials for the George Foreman Lean Mean Grilling Machine and preaching in his church. He also became a member of HBO Sports’ boxing broadcast team. In addition, Foreman also developed a clothing line, released a few books and started a promotional boxing company and a direct-to-consumer store called George Foreman’s Butcher Shop.

12. Shonda Rhimes, Founder of Shondaland

Shonda Rhimes is an iconic TV writer, producer and creator. Her passion for writing, which has fueled her success, started while she was growing up in Chicago, IL. Rhimes initially aspired to become a novelist post-graduation from Dartmouth College in 1991. However, she ended up pursuing film at the University of Southern California. Rhimes penned and directed her first short film in 1998 and wrote her first TV movie the year after. Next, she authored several screenplays for several movies, such as “Crossroads” and the Princess Diaries sequel. Later, Rhimes challenged herself by pivoting to TV series. While the first series she worked on was unsuccessful, she persevered.

Rhimes’s big break came in 2005 with the launch of the medical drama “Grey’s Anatomy,” which was an instant hit. That same year, she established her own media company, Shondaland.

Since its inception, Shondaland has expanded into an international organization that has expanded its storytelling to film, audio, digital, merchandise, editorial and more.

In 2017, Rhimes entered a partnership with Netflix that created a new brand of Shondaland. Through this partnership, Shondaland creates exclusive content for Netflix. So far, the partnership has led to the development of hit series such as “Bridgerton” and “Inventing Anna.”

Grants for Black Entrepreneurs

While many Black entrepreneurs come from humble backgrounds and struggle for both financial backing and success, there are opportunities available. Entrepreneurs from underrepresented communities can apply for several kinds of grants. These can range from federal grants to investment funds from companies. Below are a few of the available regular grants and grants for Black entrepreneurs.

1. Federal Small Business Grants for Minorities

The federal government offers many funding programs to eligible business owners. However, it is important to note that they do not provide grants that solely pay for an entrepreneur to open a business. However, they do offer funding programs to help entrepreneurs start, grow and get back on track if they are impacted by a disaster. These funding programs are available through government agencies, including the Department of Commerce and the U.S. Small Business Administration. You can get started by visiting their website and signing up. After you sign up and create an account, you can research grants to apply for that fit your needs.

2. The USDA Rural Business Development Grant Program

Black Americans comprise a small share of the population in rural communities. To put it into perspective, 2018 data from the U.S. Department of Agriculture (USDA) shows that underrepresented communities represent just 22% of the population. In particular, Black Americans represent just 7.8%. Considering that underrepresented communities make up such a small share, it is crucial to ensure that the entrepreneurs in these communities are aware of the resources available to them.

The USDA Rural Business Development Grant Program provides two types of grants — opportunity and enterprise grants. These types of grants can provide services, such as technical help and training to small rural businesses. To learn more about these grants and the eligibility requirements, visit the USDA Rural Business Development Grant Program website.

3. Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Programs

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs have a competitive and awards-based system designed to enable small businesses to explore their technological potential. The goal of these programs is to build a strong national economy. To qualify, interested small businesses must be primarily owned by U.S. citizens, be for-profit and have fewer than 500 employees. You can learn more by visiting this website.

4. National Black MBA Association® Scale-Up Pitch Challenge

The National Black MBA Association® created the Scale-Up Pitch Challenge in 2017. The Association developed the challenge to help participants start businesses that have the potential to expand. In addition to providing funding through prizes, the competition provides business owners with the opportunity to meet investors. Learn more about the challenge and prizes on the Association’s website.

5. Comcast RISE Investment Fund

Created in 2020, the Comcast RISE Investment Fund aims to help small businesses impacted by the pandemic. During the first two years of this program, 13,000 small businesses were given $110 million in grants. Most recently, the organization gave 500 recipients grant packages that offer a wealth of services, such as business consultation, academic resources and monetary grants, in addition to others. Get a better understanding of the program and eligibility requirements by visiting Comcast RISE Investment Fund’s website.

6. Rebuildtheblock Bridge the Gap Fund

Rebuildtheblock’s Bridge the Gap Fund is also a grant program that provides funds to Black entrepreneurs who have been negatively impacted by the pandemic. Established in 2020, Rebuildtheblock is an organization that works as a bridge between small businesses and legitimate resources to build generational wealth and capital for Black Americans. During each application cycle, Rebuild the Block selects 15 recipients from a pool of applicants to receive funding. Learn more about the program by visiting its website.

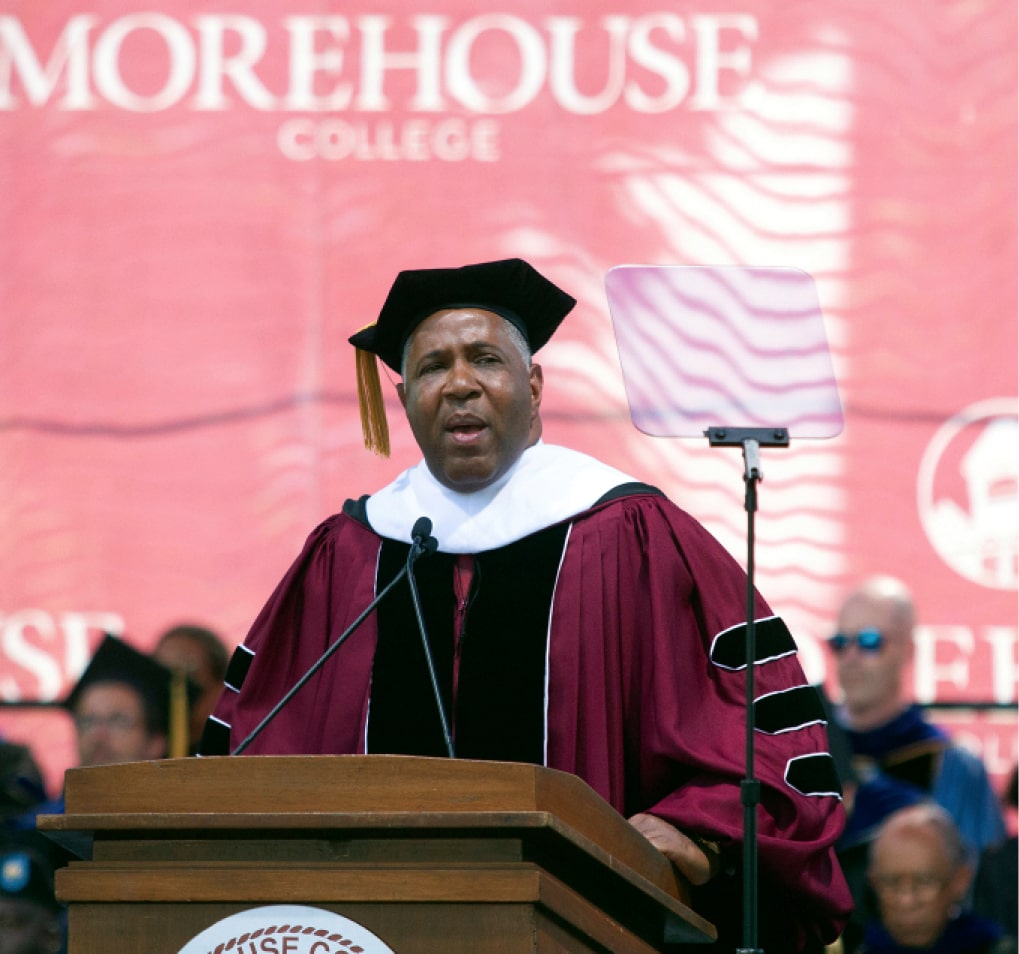

To learn more about other important topics, follow philanthropist and entrepreneur Robert F. Smith on LinkedIn.