Key Takeaways:

- Oprah Winfrey and Marian Illitch are among many accomplished female entrepreneurs.

- Female entrepreneurs face several barriers, including funding and confidence, that can limit their success in the business world.

- Grameen America and Robert F. Smith are partnering to help support the next generation of female entrepreneurs.

For centuries, men dominated the business world, with many becoming successful and famous entrepreneurs. Yet, throughout history, many lesser-known female entrepreneurs have greatly impacted society. Today, female entrepreneurs continue to make strides in breaking down gender barriers in the business world, many becoming some of the most successful entrepreneurs in their fields.

From beauty and transportation to technology and real estate, the range of industries these successful female entrepreneurs have impacted is expansive. They have established impeccable reputations and carved spaces for themselves at the top of their respective industries.

Ahead, we name some notable female entrepreneurs and examine their paths to success. We also look at barriers facing women in the current workforce and explore approaches to supporting potential female entrepreneurs. Collectively, we can help women in their drive to forge ahead as leaders and entrepreneurs.

14 Top Female Entrepreneurs

As of 2021, nearly thirteen million women own businesses in the U.S., according to a study from American Express. However, the study also showed that while women now own 40% of U.S. businesses, female entrepreneurs still face many barriers to starting a business, including limited funding, gender biases and a skewed work-life balance.

Over the decades, many women have become successful despite barriers. It is worth exploring the backgrounds of 15 successful female entrepreneurs making history in a variety of industries.

1. Thai Lee

Thai Lee is the CEO of the highly successful IT provider, SHI International. Today, the $14 billion company has over 150,000 customers, including giants like Boeing and AT&T.

Lee was born in Bangkok, Thailand, and grew up in South Korea. She moved to the United States to attend high school and later Amherst College. Her class at Amherst College was the first to include women. Her father was an economist who also attended Amherst College. He was the first Korean to graduate from the institution. Lee also attended Harvard Business School and became the institution’s first Korean woman graduate. Lee worked at Procter & Gamble and American Express before starting SHI in 1989.

2. Judy Faulkner

Judy Faulkner is the Founder and CEO of Epic Systems, a medical records software company. Today, the company supports the medical records of over $250 million patients and prestigious medical institutions like Johns Hopkins and the Mayo Clinic use the company’s products.

Faulkner started her enterprise in the basement of her home in Madison, WI, in 1979, the same year she graduated from the University of Wisconsin with a master’s degree in computer science. Since its beginning, her company has never taken venture capital or made an acquisition.

3. Judy Love

Judy Love is the cofounder of Love’s Travel Stops & Country Stores. Love founded the business in 1964 as a truck stop and convenience store in an abandoned gas station north of Oklahoma City, OK. It grew into a chain of convenience stores and truck stops with over 610 stores in 42 states that bring in an estimated revenue of $26.5 billion.

Love ran the company with her husband until his passing and now works with her children, two of whom are co-CEOs. She currently claims a spot on USA Today’s list of “America’s richest self-made women.”

4. Diane Hendricks

Diane Hendricks is the cofounder of ABC Supply Co. Inc., a building products distributor. She and her late husband started the company in 1982.

The company is the largest distributor of roofing materials in the U.S. and has operations in over 800 branch locations. Since 2007, she has been the Chairman and sole owner of the company.

5. Meg Whitman

Meg Whitman is a multifaceted entrepreneur. While she is best known as the former CEO of eBay, taking eBay’s sales from $5.7 million to $8 billion, she was also the founder of short-form video platform Quibi and former CEO of Hewlett-Packard. Whitman also holds the honor of serving as a member of a number of corporate boards of directors, including Procter & Gamble and General Motors. She is currently the U.S. ambassador to Kenya.

6. Marian Ilitch

Marian Ilitch is the cofounder of Little Caesars Pizza. This popular pizza chain opened its doors in 1959 as a single restaurant in Garden City, MI. It now operates in over 27 countries and is the third-largest pizza chain worldwide.

Ilitch and her husband are known for more than their popular pizza chain. She is a legend in the Metro Detroit area, owning two professional sports teams: the Detroit Red Wings and the Detroit Tigers. During her ownership, the Detroit Red Wings have won several honors, including four Stanley Cups.

As owner of the MotorCity Casino Hotel, she has an interest in revitalizing the Detroit area. She has committed to helping build a $1.4 billion sports and entertainment district in Detroit, known as The District Detroit.

7. Johnelle Hunt

Johnelle Hunt is a founder of JB Hunt Transport Services, a trucking firm. In 1962, she and her husband opened the doors to a rice hull packaging company in Stuttgart, AK, that would later become J.B. Hunt Transport in 1969. The trucking company went public in 1983 and is one of the biggest transportation companies in the U.S. Hunt acted as credit manager for the company and held the board position of Corporate Secretary until her retirement in 2008.

8. Lynda Resnick

Lynda Resnick is the vice-chairman and co-owner of The Wonderful Company, one the largest farming operations in the U.S. The company is known for selling everything from pistachios and clementines to lemons and wines. Resnick is also focused on philanthropy, pledging billions to different causes. Some of her efforts include addressing climate change and wellness and healthcare. She is on the Forbes list of America’s Richest Self-Made Women.

9. Gail Miller

Gail Miller is the owner of the Larry H. Miller Group. This ownership group owns interests in real estate, healthcare and finance.

She and her husband are best known for turning a single Toyota dealership into one of the largest auto dealer groups in the U.S. before selling it for $3.2 billion in 2021. She also owns a stake in the NBA team Utah Jazz and is an accomplished author, having published the book “Courage To Be You: Inspiring Lessons From An Unexpected Journey.”

10. Peggy Cherng

Peggy Cherng is the Cofounder, Co-chair and Co-CEO of the Panda Restaurant Group that runs the successful Chinese fast-food company Panda Express. Panda Express has made over $5.4 billion in sales in more than 2,300 locations since its founding in 1982.

Cherng helped open the first location in Los Angeles, CA, and built the company’s early systems, streamlining operations and helping to track customer feedback. Cherng is also the visionary behind the University of Panda, a core component of the company’s people development plan. Before founding the company, she was at McDonnell Douglas and Comtal-3M as part of leadership for the software development team.

11. Eren Ozmen

Eren Ozmen owns Sierra Nevada Corporation (SNC) and is also Chairwoman. SNC is a global aerospace and defense security leader. She is responsible for turning a small, 20-person company into a trusted, award-winning, global aerospace and defense enterprise. Ozmen has received several honors for her remarkable work with SNC, including being named to Forbes’ “50 Over 50” list, as well as being named one of the Top 10 “America’s Most Successful Self-Made Women.”

12. Oprah Winfrey

Oprah Winfrey is one of the world’s most famous Black individuals and well-known female entrepreneurs. She is widely recognized as an Emmy Award-winning talk show host, media executive, Academy Award-nominated actress and philanthropist.

Winfrey transitioned her 25-year-long talk show into a media and business empire while facilitating an acting career. In her many years as a businesswoman, she has founded a production company, Harpo Productions, and launched her own cable channel, OWN.

In contrast to all her success, Winfrey has a humble background. She was born in Kosciusko, MS, and moved to Nashville, TN, as an adolescent. She attended Tennessee State University and finished her degree in 1986, 15 years after she first started college.

13. Doris Fisher

Doris Fisher is the cofounder of Gap, Inc., a clothing retailer. She and her husband opened the first store in 1969 in San Francisco, CA, selling jeans and music. They were spurred to open a business after they couldn’t find jeans that fit her husband.

Until 2003, she served as the company’s merchandiser and continued as a board member until 2009. She is the first woman to graduate from Stanford University with an economics degree.

14. Jayshree Ullal

Jayshree Ullal is the President and CEO of Arista Networks, a computer networking firm. She is known for leading the company to a successful IPO in June 2014, which positioned the company from zero to a multibillion-dollar business. She previously worked at Advanced Micro Systems, a semiconductor giant, Fairchild Semiconductor and Cisco Systems, the software giant.

How to Become a Female Entrepreneur

Becoming a female entrepreneur is not easy. Women who attempt to break out in the business sector face several challenges. However, successful entrepreneurs have established steps to overcome barriers. Here are a few tips that could help guide budding businesswomen who aspire to become female entrepreneurs.

- Establish a Clear Vision. By establishing a clear vision, you are able to narrow the scope, audience and market you want to target.

- Find a Gap in the Market. Identify your vision and the market you want to target. Then, you can analyze where to find viable open spaces for you to enter.

- Take Thoughtful Risks. It is important to push boundaries and yourself in order to have an impact.

- Believe in Yourself. The trust you have in yourself and the belief in your vision are core elements of creating success.

- Ask for Help. The barriers females encounter are numerous. Do not hesitate to ask for help, especially from somebody with expertise in the industry.

- Analyze the Results. This step can come at any stage, but it is important to analyze what actions worked and what did not, and adjust your course for better results.

Barriers Facing Female Entrepreneurs

Along with the barriers aforementioned, the U.S. Chamber of Commerce has stated that capital, confidence and market saturation are the three most challenging barriers facing female entrepreneurs. When it comes to capital, 66% of female entrepreneurs are not able to easily secure the funding they need. In fact, in 2022, only 2% of venture capital went to female-run companies.

In terms of confidence, 59% of females say that they believe that they have to work harder for the same success level as men. This perceived gap can hurt the confidence of females trying to create a space for themselves in various industries.

How to Support Female Entrepreneurs

Despite the various barriers, we can support female entrepreneurs in many ways.

One impactful way to help inspire female entrepreneurs is through mentorship and funding opportunities. Having a mentor with experience and connections, not only helps guide a person, but it can also open doors and expand access and opportunities for a company.

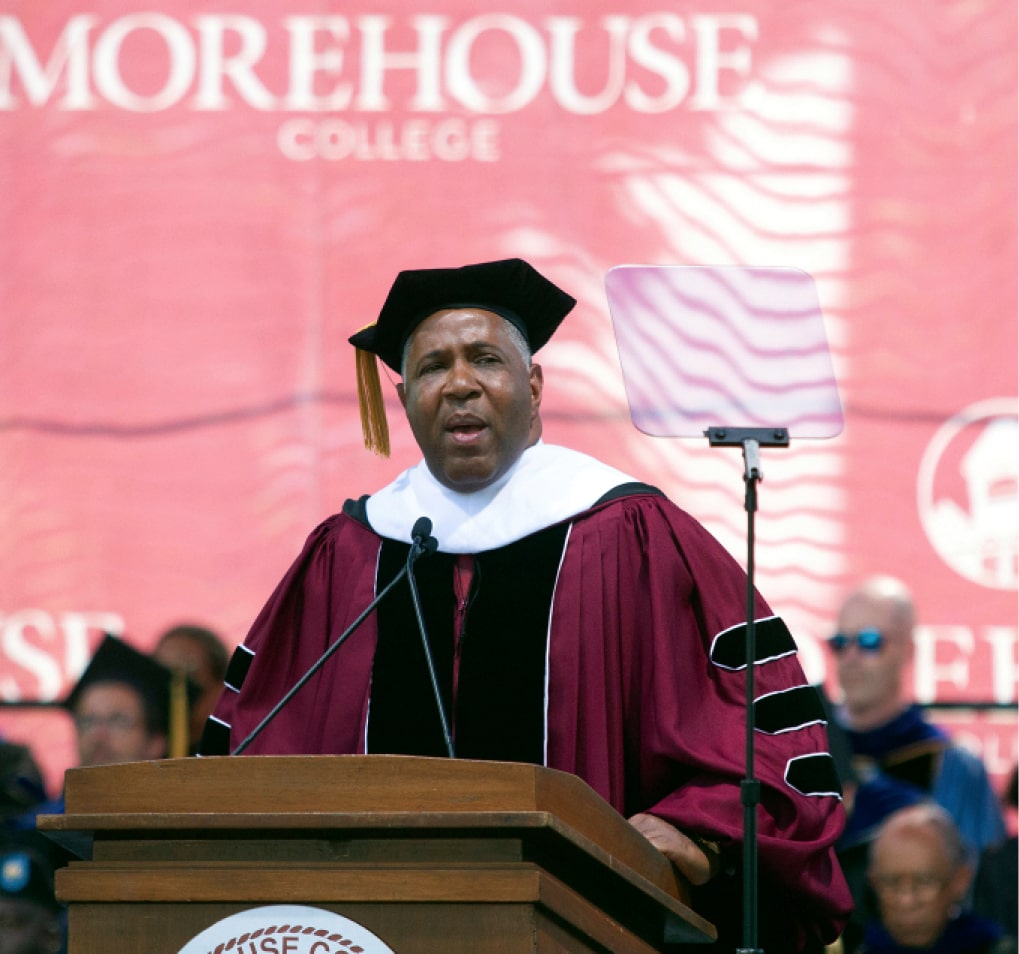

Funding is also essential. Grameen America, in partnership with Robert F. Smith, opened a new branch in Atlanta, GA, to help reach a greater number of women of color to gain ground in entrepreneurship.

Smith said the following of the partnership, “I am proud to partner with Grameen America to open this new Branch in Atlanta, one of the Southern Communities Initiative’s six regions. Together, we will expand economic opportunity in Atlanta and its surrounding communities to help close the dual racial and gender wealth gaps.”

Follow Smith on LinkedIn to learn more about supporting female entrepreneurs, en and other important topics.