Dtg84 at English Wikipedia, CC BY-SA 4.0, via Wikimedia Commons

- The U.S. Department of Education lists 102 HBCUs.

- Most HBCUs are located in the Southeast and mid-Atlantic regions of the U.S.

- The second Morrill Land-Grant Act of 1890 required states to provide land grants to create schools for Black students.

Table of Contents

Historically Black Universities and Colleges (HBCUs) across the U.S. are a great source of pride for the Black community. With a rich legacy that dates back to the 19th century, HBCUs have played a critical role in providing Black Americans with educational opportunities. Over time, these institutions have established themselves as beacons of academic excellence and empowerment.

Because these institutions have significantly impacted the Black community and society, they hold a special place in the history of U.S. higher education. Ahead, we discuss the complete number and location of HBCUs, interesting facts about each one and the importance of supporting them.

How Many HBCUs Are There?

The U.S. Department of Education identifies 102 HBCUs in the U.S., primarily located in the Southeast and mid-Atlantic states. Some are in Midwestern states like Ohio, and some are as far west as Texas.

HBCUs are more concentrated in some regions because of the circumstances surrounding their creation. The first Morrill-Land Grant Act of 1862 set the foundation for creating state colleges in the U.S. In 1890, the second Morrill Land-Grant Act carried through on the promise of the first act by requiring states to provide land grants to create schools expressly for Black students. Most of the states required to establish HBCUs were formerly Confederate states.

HBCUs offer unique and valuable educational experiences and benefits to Black Americans and others from underrepresented communities. Students are surrounded by a community of people with similar backgrounds and experiences, and the institutions provide a more affordable and diverse education. A post-graduation benefit is that the schools also have strong alumni networks that continue to support students after they graduate.

A Comprehensive List of All HBCUs By State

HBCUs across the U.S. provide students with exceptional educational experiences that prepare them for fruitful careers. HBCUs can be four-year or two-year schools, and some feature graduate programs, such as law or medical schools.

Each year, U.S. News ranks undergraduate HBCUs based on their achievements. In 2023, U.S. News ranked Spelman College the number one school, followed by Howard University and Tuskegee University. To learn more about HBCUs across the U.S., check out the complete HBCU university list below. The institutions are listed alphabetically within each state.

HBCUs in Alabama

- Alabama A&M University

- This HBCU is a four-year institution founded in 1875 as a land-grant university in Huntsville, AL.

- Alabama State University

- This HBCU was established in 1867 by nine Black Americans in Marion, AL, who wanted to create opportunities for those in the Black community to gain a quality education.

- Bishop State Community College

- Bishop State Community College is a two-year HBCU in Mobile, AL. It was founded in 1927 as the Mobile Branch of Alabama State College (University).

- Gadsden State College

- Gadsden was founded in 1925, but it was not until 1997 that the U.S. Department of Education designated this institution as an HBCU. This school started as a merger between multiple colleges. The schools that merged were Alabama Technical College, Gadsden State Technical Institute, Gadsden State Junior College and Harry M. Ayers State Technical College.

- J.F. Drake State Technical College

- J.F. Drake, founded in 1961, is in Huntsville, AL. It was established as part of former Governor George Wallace’s funding for a group of state, two-year technical institutions.

- Lawson State Community College

- Located in Birmingham, AL, Lawson is a public HBCU founded in 1949. The university has two main divisions: an academic division and a career/technical division.

- Miles College

- Miles is a private HBCU in Fairfield, AL. Christian Methodist Episcopal pastors founded it as an institution of higher learning for Black Americans.

- Miles School of Law

- This HBCU is a law school in Birmingham, AL, founded in 1974. It is independent of Miles College in Fairfield, AL.

- Oakwood University

- Located in Huntsville, AL, Oakwood is a private HBCU founded in 1896. The school is religiously affiliated with the Seventh-day Adventist Church.

- Selma University

- Selma is a private Baptist Bible college founded in 1878. The school aims to guide students spiritually and academically.

- Shelton State Community College

- Located in Tuscaloosa, AL, Shelton State is a two-year college. The school was created in 1979 by combining two institutions: Shelton State Technical College and the Tuscaloosa branch campus of Brewer State Junior College.

- Talladega College

- Talladega College is a private, four-year HBCU founded in 1867. Planning for the creation of the school started in 1865 when two Black individuals met with a group of freedmen.

- Tuskegee University

- Tuskegee is a private, four-year HBCU founded in 1881 by educator and author Booker T. Washington. Under Washington’s capable leadership, Tuskegee rose to national prominence and institutional independence.

- Trenholm State Community College

- Located in Montgomery, AL, Trenholm State is a public HBCU founded in 1963. The school was created with authorization by the Alabama State Legislature. In April 2000, it merged with John M. Patterson State Technical College.

HBCUs in Arkansas

- The University of Arkansas at Pine Bluff

- The University of Arkansas Pine Bluff was founded in 1873. It was created by the State Legislature and is the second-oldest public university in Arkansas.

- Arkansas Baptist College

- Located in Little Rock, AR, Baptist College was founded in 1884. The religious group Colored Baptists of Arkansas created the institution during an annual convention at a Baptist Church in Little Rock.

- Philander Smith College

- Philander Smith College in Little Rock, AL, was founded in 1877. The college was established to provide education to Black Americans west of the Mississippi River.

- Shorter College

- This HBCU is located in North Little Rock, AR, and was founded in 1886. The African Methodist Episcopal Church started this private two-year college.

HBCUs in Delaware

- Delaware State University

- Located in Dover, DE, the Delaware General Assembly established Delaware State in 1891. The Morrill Act of 1890 helped to generate the funds necessary to create this separate educational facility for Black Americans.

HBCUs in the District of Columbia

- The University of the District of Columbia

- In 1851, abolitionist Myrtilla Miner founded the University of the District of Columbia as a school for Black women. This school was originally called Miner Normal School. In 1929, Congress Combined the Miner Normal School and the Washington Normal School for white girls into a four-year teachers’ college.

- Howard University

- Howard University was founded in 1867 in Washington, D.C. Since its inception, the school has expanded from a single building to a series of facilities spanning more than 89 acres. Over the decades, Howard University has awarded over 100,000 arts, sciences and humanities degrees.

HBCUs in Florida

- Bethune-Cookman University

- Bethune-Cookman is in Daytona Beach, FL, and was founded in 1904 by educator Mary McLeod Bethune. When Bethune originally opened this school, it was known as the Daytona Literary and Industrial Training School for Negro Girls. It later became known as Bethune-Cookman University in 1925 after it merged with the Cookman Institute.

- Edward Waters University

- Edward Waters University is located in Jacksonville, FL, and was founded in 1866. It was established after the American Civil War by African Methodist Episcopal Church Reverend Charles H. Pearce to provide a higher education institution for Black Americans.

- Florida A&M University

- Florida A&M is in Tallahassee, FL, and was founded in 1887. The school opened with only 15 students and two instructors.

- Florida Memorial University

- Located in Miami Gardens, FL, Florida Memorial was founded in 1879. It is a private, Baptist-affiliated school created by the Bethlehem Baptist Association. This institution is the only HBCU in South Florida.

HBCUs in Georgia

- Albany State University

- Educator Joseph Winthrop Holley founded Albany State University in 1903, but it was initially called the Albany Bible and Manual Training Institute. It was established to provide religious and academic courses and teacher training for Black Americans. In 1943, the school became a four-year institution when it joined the Georgia University System and officially became known as Albany State University.

- Carver College

- Carver College was established in 1943 by the Payne family. Their success as preachers helped them first establish the institution as Carver Bible Institute. In 1998, the Board of Trustees changed the name to Carver College.

- Clark Atlanta University

- Located in Atlanta, GA, Clark Atlanta was created in 1988 after Atlanta University and Clark College were combined. The origins of the school began as early as 1920 when the National Conference of Social Work established a school of social work in Atlanta.

- Fort Valley State University

- Fort Valley State College was created in 1895 but became known as Fort Valley State University in 1996. The school was created by 15 Black men and three white men, who petitioned the Superior Court of Houston County to legalize the building of the school.

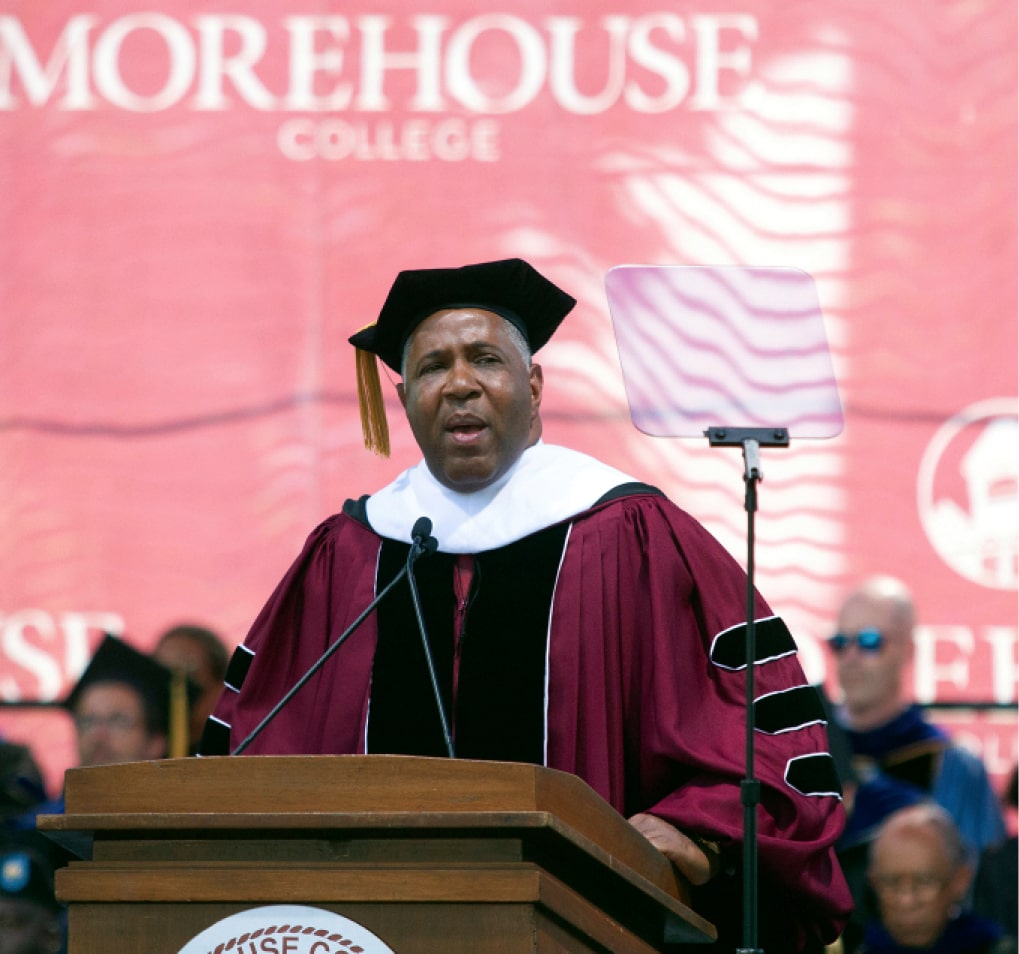

- Morehouse College

- Located in Atlanta, GA, Morehouse is an all-male HBCU founded in 1867. Some of the school’s famous alumni include Dr. Martin Luther King Jr., Samuel L. Jackson and Spike Lee. In 2019, Robert F. Smith donated $34 million to Morehouse College to cover the student loan debt of the graduating class.

- Morehouse School of Medicine

- The Morehouse School of Medicine was founded in 1975 in Atlanta, GA. It was first known as the Medical Education Program at Morehouse College. It became an independent institution in 1981.

- Morris Brown College

- Morris Brown is a private liberal arts college in Atlanta, GA, founded in 1881 by the African Methodist Episcopal Church.

- Paine College

- Located in Augusta, Paine College was founded in 1883 by the United Methodist Church and the Christian Methodist Episcopal Church.

- Savannah State University

- Savannah State was founded in 1890 and was the first public HBCU to open in Georgia. It was also the first higher education institution created in Savannah, GA.

- Spelman College

- Spelman, an all-women HBCU, originally opened in 1881 as the Atlanta Baptist Female Seminary. It is the sister school to Morehouse. These two universities often collaborate on special events, such as homecoming celebrations.

Linkedin Exclusive

Get Industry leading insights from Robert F. Smith directly in your LinkedIn feed.

Get Industry leading insights from Robert F. Smith directly in your LinkedIn feed.

HBCUs in Kentucky

- Kentucky State University

- Kentucky State is located in Frankfort, KY, and was founded in 1886 by the state legislature. The school’s original mission was to train Black teachers, but later it expanded its purpose and became a liberal arts institution.

- Simmons College of Kentucky

- Simmons College was founded in 1879 in Louisville, KY. The founders were members of the Kentucky State Convention of Colored Baptist Churches who asked the State Convention for land for the first post-secondary educational institute for Black citizens. The State Convention purchased four acres of land that eventually became the location for Simmons College of Kentucky.

HBCUs in Louisiana

- Dillard University

- Dillard University in New Orleans was founded in 1935 by education reformer James Hardy Dillard. The school was created to be a center for education excellence in the South.

- Grambling State University

- The school was founded in 1901 and is located in Grambling, LA. The Agriculture Relief Association, a group of Black farmers, originally opened the school as a Black industrial and agricultural school.

- Southern University and A&M College

- Southern University and A&M College in Baton Rouge was founded in 1880. More than 140 years ago, three delegates presented their vision for higher education for Black Americans at the Louisiana State Constructional Convention. The result of the presentation was legislative Act 87, which led to the creation of Southern University and A&M College. Today the school is a trailblazer in the higher education world with over 30 academic programs.

- Southern University at New Orleans

- Southern University was founded in 1956 at the height of the Civil Rights Movement to discourage Black Americans from attending predominantly white universities, where many of them were facing aggression. The university is state-supported and is a part of the Southern University System.

- Southern University Shreveport Louisiana

- This university is a branch of the Southern University System. It was created by Act 42 through the Louisiana Legislature in 1964 and officially opened in 1967.

- Xavier University in New Orleans

- Xavier University is the first Catholic HBCU, opening in 1915 as a high school. In 1925, the school officially became a university when the College of Liberal Arts and Sciences was created.

HBCUs in Maryland

- Bowie State University

- Bowie State was formed in 1865 in Bowie, MD. The institution was created to offer education to Black Americans.

- Coppin State University

- Coppin State is located in Baltimore, MD, and was founded as a high school in 1900. It opened with a one-year program to train future Black elementary school teachers. In 1950, the school became a part of the higher education system of Maryland, under the State Department of Education.

- University of Maryland Eastern Shore

- Maryland Eastern Shore was founded in 1886 in Princess Anne, MD. This university began as a branch of Baltimore’s Centenary Bible Institute. Federal funding from the second Morrill-Land Grant Act helped the school transform into an HBCU.

- Morgan State University

- Morgan State was founded in 1867 in Baltimore, MD. When it first opened, the school was The Centenary Biblical Institute of the Methodist Episcopal Church and had a mission to train young men in the ministry. The school later broadened its mission to educate men and women as teachers and officially became known as Morgan State in 1890.

HBCUs in Mississippi

- Alcorn State University

- Alcorn State is the oldest land-grant, public HBCU in the U.S. The state of Mississippi founded the school in 1871 as a school for Black Americans.

- Coahoma Community College

- Coahoma is a public community college in Clarksdale, MS. The school was originally founded in 1924 as the Coahoma County Agricultural High School. In 1949, the school added a junior college curriculum.

- Hinds County Community College

- Hinds County Community College is a public community college with six locations in Mississippi. Founded in 1917, Hinds County Community College started as an agricultural high school. Since then, the school has become the state’s biggest community college and the fourth-largest institution of higher education.

- Jackson State University

- Jackson State began as the Natchez Seminary in 1877 to educate Black Christian leaders. When the state assumed responsibility for the college in 1940, the curriculum expanded to include graduate and bachelor’s programs in arts and sciences. The name officially changed to Jackson State in 1956.

- Mississippi Valley State University

- Mississippi Valley is a public university in Itta Bena, MS, founded in 1950. The Mississippi legislature created the university, originally known as the Mississippi Vocational College. The original purpose of the college was to train teachers for rural schools.

- Rust College

- Rust College, located in Holly Spring, MS, was founded in 1866. It was founded by the Freedmen’s Aid Society of the Methodist Episcopal Church. The missionary founders came from the North to open an elementary school that later expanded into a high school and college.

- Tougaloo College

- Tougaloo College was founded in 1869 after the American Missionary Association of New York purchased land to create a school. In 1871, the Mississippi State Legislature gave the institution a charter under Tougaloo University.

HBCUs in Missouri

- Harris-Stowe State University

- Harris-Stowe State is in St. Louis, MO. The school’s creation was a result of the 1954 Civil Rights Act that ordered the integration of Stowe Teachers College and Harris Teachers College. The school’s mission is to offer affordable, high-quality education to underserved populations.

- Lincoln University

- Located in Jefferson City, MO, Lincoln University is a public HBCU. After the end of the American Civil War, the 62nd U.S. Colored Infantry pooled their money to create an educational institution. Lincoln University was formally established in 1866.

HBCUs in North Carolina

- Bennett College

- Bennett College in Greensboro, NC, was founded in 1873. It started in the basement of the Warnersville Methodist Episcopal Church, with young men and women starting elementary and high school studies. The Freedmen’s Aid Society took over the school in 1874. After five years, a group of Black Americans purchased the land for the school and added college-level courses.

- Elizabeth City State University

- This university is located in Elizabeth City, NC, and was founded in 1891. It was created to bring education to Black American students.

- Fayetteville State University

- Founded in 1867, Fayetteville State is a public university in Fayetteville, NC. Formerly a teacher’s school, Fayetteville State became a part of the University of North Carolina System in 1969.

- Johnson C. Smith University

- Johnson C. Smith is a private university in Charlotte, NC. This university was founded in 1867 by Reverend (Rev.) S.C. Alexander and Rev. W. L. Miller. The North Carolina State Board of Education recognized it as a four-year college in 1924.

- Livingstone College

- This private college in Salisbury, NC, Livingstone was originally founded in 1879 as the Zion Wesley Institution (as named by A.M.E. Zion ministers). Their goal was to train ministers in their town.

- North Carolina Central University

- North Carolina Central is a public University located in Durham, NC. The school was founded by businessman Dr. James E. Shepard in 1910.

- North Carolina A&T State University

- Located in Greensboro, NC, North Carolina A&T is a public university founded in 1891. The original goal of the school was to teach Black Americans agricultural and mechanical skills.

- Shaw University

- Shaw University is in Raleigh, NC, and was founded in 1865 and was the first HBCU in the Southern U.S. The school is affiliated with the Baptist Church.

- St. Augustine’s University

- Saint Augustine’s was founded in 1867 by Rev. J. Brinton Smith and Right Rev. Thomas Atkinson. The school officially became a four-year institution in 1927.

HBCUs in Ohio

- Central State University

- Central State University was established in 1887. The state legislature originally established the first department for Central State on the Wilberforce campus. In 1951, Central State gained independence as a college.

- Wilberforce University

- Wilberforce University was founded before the American Civil War in 1856. During that time, the school was a freedom destination for the Ohio Underground Railroad. Wilberforce is the oldest private HBCU in the U.S.

HBCUs in Oklahoma

- Langston University

- Black residents of Langston, OK, petitioned the Oklahoma School and College Commission in 1892 for the creation of an educational institution. Langston University was officially established in 1897.

HBCUs in Pennsylvania

- Cheyney University of Pennsylvania

- Cheyney University, founded in 1837 in Cheyney, PA, was the first HBCU in the U.S. The university was established by Quaker philanthropist Richard Humphreys, who gave a 10th of his estate to make a school to educate Black Americans.

- Lincoln University

- Lincoln University was granted its charter from the Commonwealth of Pennsylvania in 1854. It was the first degree-granting HBCU and is located in Oxford, PA.

HBCUs in South Carolina

- Allen University

- Allen University in Columbia, SC, was founded by the African Methodist Episcopal Church in 1870. The school’s mission is to promote spiritual growth and educate future leaders.

- Benedict College

- Benedict College is a private institution founded in 1870 by abolitionist Bathsheba A. Benedict. The school is a liberal arts institution with more than 1,700 students.

- Claflin University

- Located in Orangeburg, SC, Claflin University was founded in 1869. The university was named after Methodist Layman Lee Claflin and his son, who was the governor of Massachusetts at the time.

- Clinton College

- Clinton College was formed in 1894 in Rock Hill, SC, by the African Methodist Episcopal Zion Church. The original goal of the school was to improve the reading skills of the freedman population.

- Denmark Technical College

- Denmark Technical College is a two-year institution that offers career and transfer education. It was established by the South Carolina General Assembly in 1947.

- Morris College

- Morris College was created under authorization by the Baptist Education and Missionary Convention of South Carolina in 1906. However, it was officially founded in 1908 and was established to train Black Americans and guide them through their Christian journey.

- South Carolina State University

- South Carolina State, located in Orangeburg, SC, was founded in 1896. It was created by legislation from the South Carolina General Assembly.

- Voorhees University

- Voorhees University in Denmark, SC, was founded in 1897 by educator Elizabeth Evelyn Wright. Wright started the school with support from philanthropist Ralph Voorhees and the Episcopal Church.

HBCUs in Tennessee

- American Baptist University

- The American Baptist University was founded in 1924 by the National Baptist Convention and Southern Baptist Convention. The school is located in Nashville, TN.

- Fisk University

- Fisk University, located in Nashville, TN, was established in 1865 by John Ogden, Rev. Erastus Milo Cravath and Rev. Edward P. Smith. The school started offering classes in 1866.

- Lane College

- The Christian Methodist Episcopal Church established the school that became Lane College in 1882. The church’s top priority was to create schools to educate Black Americans after the American Civil War.

- LeMoyne-Owen College

- This school is the combination of two institutions: LeMoyne College and Owen College. LeMoyne College was destroyed in a fire by race riots in 1866, but it was rebuilt in 1867. Owen College was established in 1947 by the Tennessee Baptist Missionary and Educational Convention. These schools merged to form LeMoyne-Owen College in 1968.

- Meharry Medical College

- Meharry Medical College was founded in 1876. It is one of the oldest and biggest HBCU health science centers in the U.S.

- Tennessee State University

- Tennessee State University is a public HBCU founded in 1912 in Nashville, TN. The original iteration of the university was created from a state land grant. It became the school it is today from the 1979 merger of Tennessee State University and the University of Tennessee at Nashville.

HBCUs in Texas

- Huston-Tillotson University

- Huston-Tillotson’s story starts in 1875 with the Freedmen’s Aid Society of the American Missionary Association of the Congressional Churches. The school was chartered in 1877 and classes began in 1881.

- Jarvis Christian College

- Jarvis Christian University was established by the Disciples of Christ in Texas and the Christian Women’s Board of Missions. It is located in Hawkins, TX, and classes at the school began in 1913.

- Paul Quinn College

- Located in Waco, TX, Paul Quinn College was the first HBCU in the state. It was founded by African Methodist Episcopal Church preachers in 1872.

- Prairie View A&M University

- Prairie View A&M was the first state-supported HBCU in Texas. It was established in 1876 during the reconstruction period.

- Southwestern Christian College

- Southwestern Christian College in Fort Worth, TX, was originally known as the Southern Bible Institute. Southwestern Christian College was created in 1948, but it switched locations in 1949 to buildings that housed the Texas Military College.

- St. Philip’s College

- St. Philip’s was founded by the Protestant Episcopal Church and officially opened its doors in 1898. It is a public college located in San Antonio, TX.

- Texas College

- Texas College in Tyler, TX, was founded in 1894 by a group of Christian Methodist Ministers. The college was created to represent the start of education for the disenfranchised in Texas.

- Texas Southern University

- Texas Southern originally started as a junior college in 1927 and became Texas Southern University 1951. Texas Southern is in Houston, TX.

- Wiley College

- Wiley College in Marshall was founded by the Freedmen’s Aid Society of Methodist Episcopal Church in 1873. It was created to give Black Americans access to higher education.

HBCUs in the U.S. Virgin Islands

- University of the Virgin Islands

- The University of the Virgin Islands was chartered in 1962 from Act No. 851 of the Fourth Legislature of the U.S. Virgin Islands. It is a publically-funded liberal arts institution and has one campus in St. Thomas and one campus in St. Croix.

HBCUs in Virginia

- Hampton University

- Hampton University was started in 1861 by Black American and educator Mary Peake. Since its inception, the school has expanded from Peake’s initial classes under oak trees to a large campus in Hampton, VA.

- Norfolk State University

- Norfolk State was founded in the middle of the Great Depression in 1935. It was created to provide youth with a way to explore and achieve their aspirations. The university was originally named Norfolk Unit of Virginia Union University.

- Virginia State University

- Virginia State was founded in Petersburg, VA, by a charter of the state in 1882. The university now has a student population of more than 4,000.

- Virginia Union University

- Virginia Union was founded in 1865 to provide Black Americans with an academic and religious education. Virginia Union’s campus is in Richmond, VA.

- Virginia University of Lynchburg

- Virginia University of Lynchburg was originally named the Lynchburg Baptist Seminary. It was chartered in 1888 after the Virginia Baptist State Convention made Lynchburg, VA, the location for the seminary college in 1886.

HBCUs in West Virginia

- Bluefield State College

- Bluefield State College, founded in 1895, was established to provide higher education to the kids of Black coal miners in the area. The campus is located in Bluefield, WV.

- West Virginia State University

- West Virginia State was created under the Second Morrill Act of 1890. Starting in 1891, the institution offered high school education, teacher training and vocational education. In 2004, it was granted university status by the West Virginia State Legislature.

Learn about Smith’s support for HBCUs by following him on LinkedIn.